News

24/04/2025

Nestlé: strongest organic growth delivered in confectionery and coffee

Nestlé Group`s total reported sales in the first three months of 2025 increased by 2.3% to CHF 22.601 bn, including impacts of - 0.5% from foreign exchange movements and 0.1% from net acquisitions.

SG

TO THE ARTICLE

16/04/2025 | International

Ferrero invests 285 million Euros to expand Brantford, Ontario site

The Ferrero Group has announced an investment of € 285 m (CAD 445 m), to expand its production facility in Brantford, Ontario, Canada.

SG

TO THE ARTICLE

16/04/2025 | International

Giovanni Ferrero receives the 2025 Leonardo Award

Giovanni Ferrero, Executive Chairman of Ferrero Group, was honoured with the prestigious Premio Leonardo 2025 by the Leonardo Committee in recognition of his entrepreneurial vision, innovation approach and people-centered leadership.

SG

TO THE ARTICLE

14/04/2025 | Ingredients

Beneo inaugurates new pulse-processing plant

The site in Germany processes local pulses into high-quality food and feed ingredients

SP

TO THE ARTICLE

10/04/2025

NEWSLETTER ADVERTORIAL: Syntegon – Every biscuit & cracker counts

that’s the guiding principle behind Syntegon’s innovative packaging solutions. But a biscuit isn’t just a biscuit. Round or square, filled or chocolate-coated, sandwich biscuit or cracker – your products are ... SP

10/04/2025 | Industry, International

Barry Callebaut: protecting EBIT despite declining demand due to unprecedented cocoa prices

The Barry Callebaut Group reported sales volume of 1.085 m tonnes in the first six months of fiscal year 2024/25 (ended February 28, 2025).

SG SP

TO THE ARTICLE

09/04/2025 | Packaging

Sculpteo launches PA12 Blue: An Innovative 3D Printing Material Compliant with Food Industry Standards

The company announces the launch of PA12 Blue food grade, an innovative plastic material designed to meet the requirements of industrial environments where hygiene, traceability, and safety are priorities.

SP

TO THE ARTICLE

07/04/2025 | Packaging

Gold medal for Herma from EcoVadis for the first time

This means that the company is among the top 5% of the companies audited by EcoVadis in the last 12 months; previously Herma was among the top 12%.

SP

TO THE ARTICLE

02/04/2025 | Technology

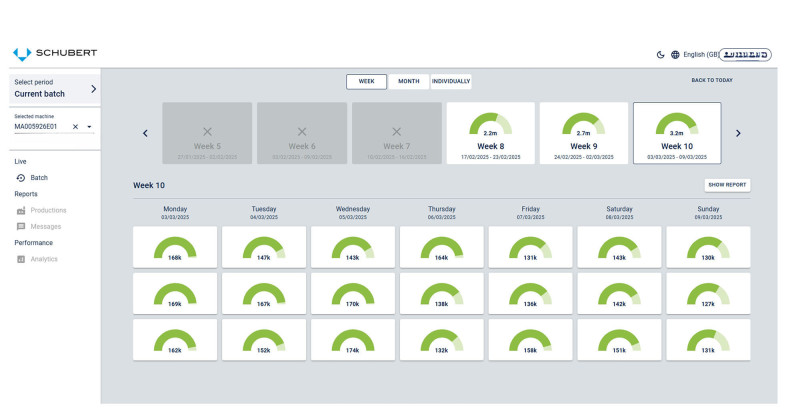

Optimising OEE: Schubert upgrades its CARE platform for machine monitoring

Gerhard Schubert GmbH has designed and, in 2025, significantly expanded its proprietary CARE monitoring solution – short for ‘Connection for Analytics, Reporting and Efficiency’.

SP

TO THE ARTICLE

02/04/2025 | Ingredients

GNT advances CO2 reduction goals in latest sustainability report

GNT has passed the halfway mark in its mission to reduce carbon intensity at its Exberry® colour factories by 50% over the course of the current decade.

SG SP

TO THE ARTICLE

31/03/2025 | Particulars, Technology

New Management Team at Handtmann Processing

The continuation of the strategy requires organizational structure development

SP

TO THE ARTICLE

31/03/2025 | Ingredients

Vitafoods and PLMA: SternLife focuses on enjoyable protein bars

At Vitafoods in Barcelona and PLMA in Amsterdam, the new ‘Better Snacking’ range will take center stage at SternLife.

SP

TO THE ARTICLE

28/03/2025 | Ingredients

Döhler North America expands with acquisition of premier juices, strengthening market presence and customer offering

The company is expanding its presence with the strategic acquisition of Premier Juices, strengthening its offerings in natural fruit-based products and solutions.

SP

TO THE ARTICLE

28/03/2025 | Technology

EGE-Ektronik: customized special sensors "Made in Germany"

The company flexibly fulfils a wide range of customer requirements – from OEM designs with company logos to special materials for aggressive media and processes with high-pressure cleaning.

SP

TO THE ARTICLE

25/03/2025 | Ingredients

TopGum unveils its latest gummy creation: fruity chewable synbiotics

Gummy supplement pioneer TopGum Industries, Ltd. (TASE: TPGM), launches its latest innovation, synbiotic Gummiotics™.

SP

TO THE ARTICLE