Nielsen confectionery monitor: solid increase in the first half-year

The highest percentage rate increases once again came from the category salty snacks with revenues of € 1.613 bn (+ 7.6%) and sales volume of 202,324 tonnes (+ 3.3%). Revenues were driven by the partial segments of premium nuts (+ 16.8%), snack specialities (+ 16.1%), peanut flips (+ 13.1%), tortillas (+ 18.3%) and popcorn (+ 22.5%).

The largest product group, chocolate goods, achieved an increase in revenues of 1.4% up to € 3.252 bn (sales volume + 0.8%; 308,748 t) with significant revenue growth among praline-like products (+ 8.0%), tablets up to 100 grams (+ 5.7%) and other bars (+ 34.7%). The baked goods category enjoyed above-average development with an increase in revenues of 4.0% up to € 810.6 m (sales volume + 0.9%; 143,805 t), driven by a strong increase in earnings in the segments of other baked goods without chocolate (+ 11.3%), wafers without chocolate (+ 32.4%), seasonal baked goods (+ 11.7%) and shortbread (+ 18.7%). Sugar confectionery suppliers suffered a mild loss in revenues of 1.1% down to € 1.282 bn (sales volume + 0.4%; 183,239 t). Revenues only grew in the largest segment of fruit and wine gum/marshmallow/liquorice (+ 1.1%).

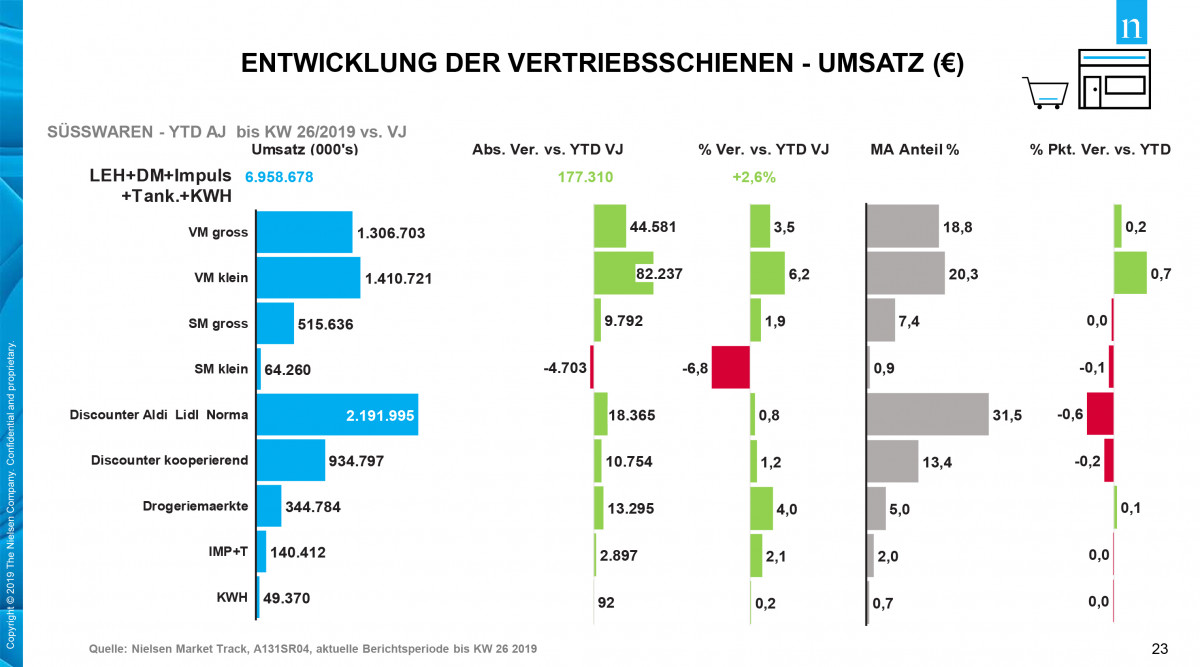

Revenue development in the individual sales channels revealed notable profits in small consumer markets (+ 6.2%), drug stores (+ 4.0%) and large consumer markets (+ 3.5%), with only small supermarkets falling under the previous year’s level (- 6.8%).